1 min read

Choosing the Right Payroll and HR Software

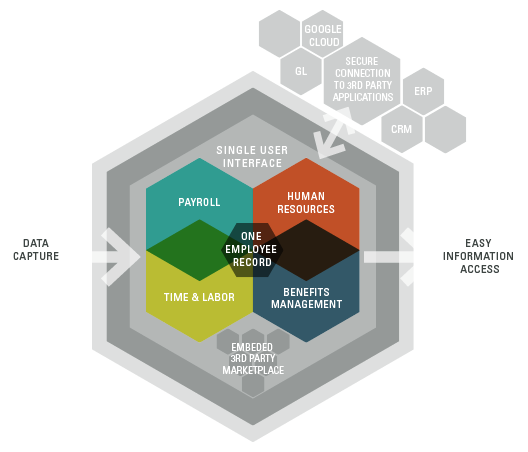

To ensure the proper payroll and Human Resources (HR) system is in place for your organization, you first need to evaluate both your business needs...

Are you prepared for the next wave of tax, healthcare and regulatory changes affecting payroll and HR?

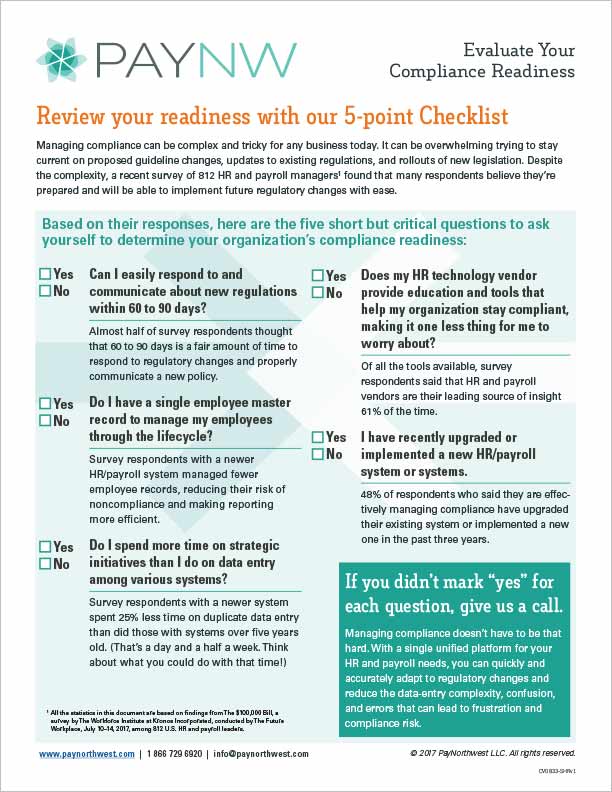

Managing compliance can be complex and tricky for any business today. It can be overwhelming trying to stay current on proposed guideline changes, updates to existing regulations, and rollouts of new legislation.

Despite the complexity, a recent survey of 812 HR and payroll managers found that many respondents believe they’re prepared and will be able to implement future regulatory changes with ease.

Based on their responses, we’ve compiled five short but critical questions to ask yourself to determine your organization’s compliance readiness.

Or, for more information on more recent updates such as the new EEO Reporting and Data Collection requirements, see our blog.

Fill out the form below for an instant download of our Compliance Readiness Checklist.

1 min read

To ensure the proper payroll and Human Resources (HR) system is in place for your organization, you first need to evaluate both your business needs...

3 min read

Maintaining your top employees in 2025 will be about more than just paying them well; it also will be about giving them an experience that makes them...

Please join us for a free webinar! Correctly calculating travel time and on-call pay can be a challenge. We’ll help you navigate both, starting...